Page 71 - Export Magazine

P. 71

REPOR T

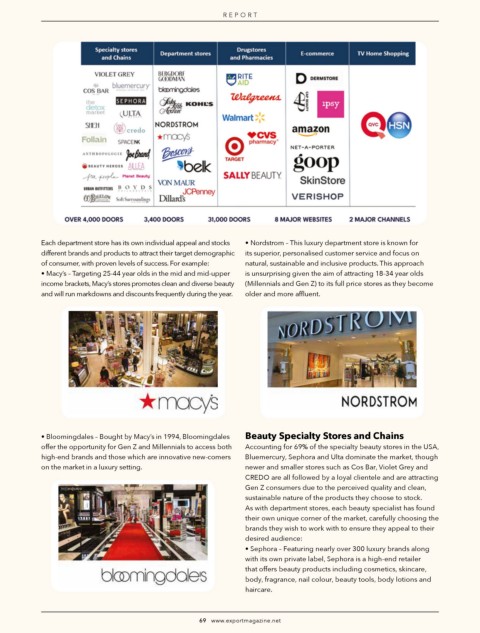

Each department store has its own individual appeal and stocks • Nordstrom – This luxury department store is known for

different brands and products to attract their target demographic its superior, personalised customer service and focus on

of consumer, with proven levels of success. For example: natural, sustainable and inclusive products. This approach

• Macy’s – Targeting 25-44 year olds in the mid and mid-upper is unsurprising given the aim of attracting 18-34 year olds

income brackets, Macy’s stores promotes clean and diverse beauty (Millennials and Gen Z) to its full price stores as they become

and will run markdowns and discounts frequently during the year. older and more affluent.

• Bloomingdales – Bought by Macy’s in 1994, Bloomingdales Beauty Specialty Stores and Chains

offer the opportunity for Gen Z and Millennials to access both Accounting for 69% of the specialty beauty stores in the USA,

high-end brands and those which are innovative new-comers Bluemercury, Sephora and Ulta dominate the market, though

on the market in a luxury setting. newer and smaller stores such as Cos Bar, Violet Grey and

CREDO are all followed by a loyal clientele and are attracting

Gen Z consumers due to the perceived quality and clean,

sustainable nature of the products they choose to stock.

As with department stores, each beauty specialist has found

their own unique corner of the market, carefully choosing the

brands they wish to work with to ensure they appeal to their

desired audience:

• Sephora – Featuring nearly over 300 luxury brands along

with its own private label, Sephora is a high-end retailer

that offers beauty products including cosmetics, skincare,

body, fragrance, nail colour, beauty tools, body lotions and

haircare.

69 www.exportmagazine.net

69 www .e xpor tmagazine.net