Page 41 - EM Export Magazine Perfumery edition

P. 41

R E P O R T

Today the elegant twin store occupies some 14,200sq ft of Louis Vuitton owner LVMH, Shiseido and other luxury brands

space, featuring many of the world’s most renowned beauty tumbled last fall on signs that Chinese customs officials were

brands complemented by an increasing focus on emergent cracking down on travelers returning from fashion meccas

names. “When we started here we had about 8,500sq feet,” with undeclared merchandise.

says Falic. “As I say, every time space became available, we took China also halved some import taxes, prompting brands

it and we were able to fill it with the right brands.” Given that the to lower their mainland prices. A Vuitton New Wave MM

average daily footfall into the Venetian is currently running at handbag that sells for 1,680 euros in France now costs only

around 60,000 a day (peaking around 100,000 during Chinese about 10 percent more in China. That’s taken a lot of air out

New year) with rising store penetration, Falic believes that his of daigou demand, as did a legal change that cut the cost of

store’s success is sure to continue: “I assure you, this is non- online purchases. Now, buyers in China can order goods from

stop traffic all day and this is only the beginning.” abroad without paying customs duties, just a relatively small

personal parcel tax.

Additionally, China has been encouraging luxury brands to

open stores on the mainland. The Chinese government has

cut mainland import taxes, and retail prices have fallen as a

result. Goods that used to cost 25% to 35% more in Beijing or

Shanghai, for example, now sell at a much smaller premium.

At an Hermès store in Hong Kong, a calfskin wallet sells for

HK$26,700 ($3,438). Chinese online platform Tmall advertises

the same wallet, which ships from Italy, for 24,580 yuan

($3,589), a premium of less than 5%.

Shoppers thus have less incentive to go to a daigou seller.

And yet, some analysts say the daigou constitute too large an

industry to simply fall away entirely. Only time will tell whether

the daigou will stand or fall, and how their fate’s impact will

shape Nepal’s beauty & personal care market.

For now, daigou or not, cosmetics in Nepal are still attracting

the Chinese consumer. Let’s look at some of the other reasons

for Nepal’s popularity among cosmetics shoppers.

WhY thE MarKEt FOr COSMEtiC

PrODUCtS in nEPaL aPPEaLS

tO thE ChinESE COnSUMEr

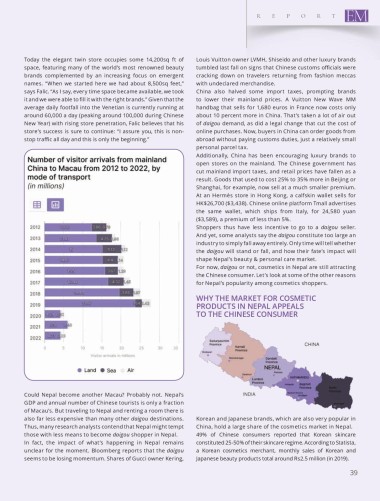

Could Nepal become another Macau? Probably not. Nepal’s

GDP and annual number of Chinese tourists is only a fraction

of Macau’s. But traveling to Nepal and renting a room there is

also far less expensive than many other daigou destinations. Korean and Japanese brands, which are also very popular in

Thus, many research analysts contend that Nepal might tempt China, hold a large share of the cosmetics market in Nepal.

those with less means to become daigou shopper in Nepal. 49% of Chinese consumers reported that Korean skincare

In fact, the impact of what’s happening in Nepal remains constituted 25-50% of their skincare regime. According to Statista,

unclear for the moment. Bloomberg reports that the daigou a Korean cosmetics merchant, monthly sales of Korean and

seems to be losing momentum. Shares of Gucci owner Kering, Japanese beauty products total around Rs2.5 million (in 2019).

39