Page 42 - EM Export Magazine Perfumery edition

P. 42

R E P O R T

showed that Rohto’s products would be in demand here.”

Rohto has developed a skin care line in Nepal. The cosmetic

line is distributed by Vishal Group and the pharmaceutical

products by BK Group. Rohto’s philosophy behind its skin care

products is to “localise” each country’s skincare line, adapting

the products to the demands of the local environment & its

effects on the skin. The company’s skin care products, in fact,

represent over 60% of its total sales, nearly 40% of which are

generated overseas (not in Japan). Other Japenese brands such

as Meishoku, Momotani, Kirie Cosme, Sensai, and Shiseido are

also readily available in Nepal for purchase.

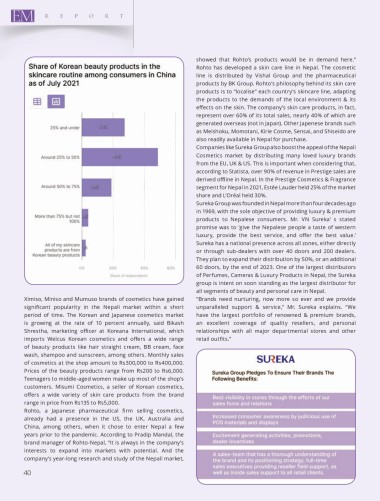

Companies like Sureka Group also boost the appeal of the Nepali

Cosmetics market by distributing many loved luxury brands

from the EU, UK & US. This is important when considering that,

according to Statista, over 90% of revenue in Prestige sales are

derived offline in Nepal. In the Prestige Cosmetics & Fragrance

segment for Nepal in 2021, Estée Lauder held 25% of the market

share and L’Oréal held 30%.

Sureka Group was founded in Nepal more than four decades ago

in 1969, with the sole objective of providing luxury & premium

products to Nepalese consumers. Mr. VN Sureka’ s stated

promise was to ‘give the Nepalese people a taste of western

luxury, provide the best service, and offer the best value.’

Sureka has a national presence across all zones, either directly

or through sub-dealers with over 40 doors and 200 dealers.

They plan to expand their distribution by 50%, or an additional

60 doors, by the end of 2023. One of the largest distributors

of Perfumes, Cameras & Luxury Products in Nepal, the Sureka

group is intent on soon standing as the largest distributor for

all segments of beauty and personal care in Nepal.

Ximiso, Miniso and Mumuso brands of cosmetics have gained “Brands need nurturing, now more so ever and we provide

significant popularity in the Nepali market within a short unparalleled support & service,” Mr. Sureka explains. “We

period of time. The Korean and Japanese cosmetics market have the largest portfolio of renowned & premium brands,

is growing at the rate of 10 percent annually, said Bikash an excellent coverage of quality resellers, and personal

Shrestha, marketing officer at Koreana International, which relationships with all major departmental stores and other

imports Welcus Korean cosmetics and offers a wide range retail outfits.”

of beauty products like hair straight cream, BB cream, face

wash, shampoo and sunscreen, among others. Monthly sales

of cosmetics at the shop amount to Rs300,000 to Rs400,000.

Prices of the beauty products range from Rs200 to Rs6,000.

Teenagers to middle-aged women make up most of the shop’s

customers. Misumi Cosmetics, a seller of Korean cosmetics,

offers a wide variety of skin care products from the brand

range in price from Rs135 to Rs5,000.

Rohto, a Japanese pharmaceutical firm selling cosmetics,

already had a presence in the US, the UK, Australia and

China, among others, when it chose to enter Nepal a few

years prior to the pandemic. According to Pradip Mandal, the

brand manager of Rohto-Nepal, “It is always in the company’s

interests to expand into markets with potential. And the

company’s year-long research and study of the Nepali market,

40