Page 39 - EM Export Magazine Perfumery edition

P. 39

R E P O R T

hOW COViD’S iMPaCt On thE ChinESE

PErSOnaL ShOPPEr haS GiVEn riSE tO

CrOSS-BOrDEr ECOMMErCE PLatFOrMS

According to Statistica, more than 70 percent of cosmetics

retail sales revenue in China came from e-commerce channels.

Most (online) Beauty Care sales in Nepal are also generated

from China. Chinese shoppers it seems are flocking to Nepal

both online and offline. Though there are many reasons for

this proclivity towards Nepal as a shopping destination. One

cause has to do with the recent effects of COVID on the Chinese

personal shopper or daigou.

The daigou are an army of gray-market surrogate shoppers

that have long been a feature of China’s retail sector, serving

consumers who crave items that aren’t available locally, or are

sometimes significantly more expensive in the country.

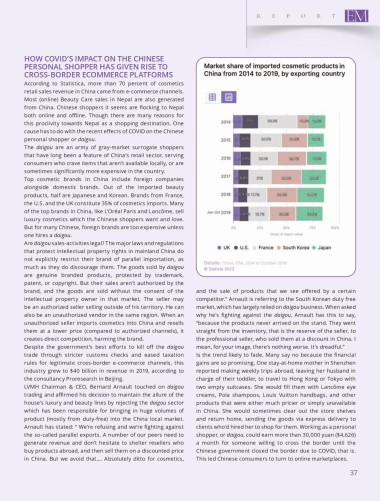

Top cosmetic brands in China include foreign companies

alongside domestic brands. Out of the imported beauty

products, half are Japanese and Korean. Brands from France,

the U.S. and the UK constitute 35% of cosmetics imports. Many

of the top brands in China, like L’Oréal Paris and Lancôme, sell

luxury cosmetics which the Chinese shoppers want and love.

But for many Chinese, foreign brands are too expensive unless

one hires a daigou.

Are daigou sales-activities legal? The major laws and regulations

that protect intellectual property rights in mainland China do

not explicitly restrict their brand of parallel importation, as

much as they do discourage them. The goods sold by daigou

are genuine branded products, protected by trademark,

patent, or copyright. But their sales aren’t authorized by the

brand, and the goods are sold without the consent of the and the sale of products that we see offered by a certain

intellectual property owner in that market. The seller may competitor.” Arnault is referring to the South Korean duty free

be an authorized seller selling outside of his territory. He can market, which has largely relied on daigou business. When asked

also be an unauthorized vendor in the same region. When an why he’s fighting against the daigou, Arnault has this to say,

unauthorized seller imports cosmetics into China and resells “because the products never arrived on the stand. They went

them at a lower price (compared to authorized channels), it straight from the inventory, that is the reserve of the seller, to

creates direct competition, harming the brand. the professional seller, who sold them at a discount in China. I

Despite the government’s best efforts to kill off the daigou mean, for your image, there’s nothing worse. It’s dreadful.”

trade through stricter customs checks and eased taxation Is the trend likely to fade. Many say no because the financial

rules for legitimate cross-border e-commerce channels, this gains are so promising. One stay-at-home mother in Shenzhen

industry grew to $40 billion in revenue in 2019, according to reported making weekly trips abroad, leaving her husband in

the consultancy Proresearch in Beijing. charge of their toddler, to travel to Hong Kong or Tokyo with

LVMH Chairman & CEO, Bernard Arnault touched on daigou two empty suitcases. She would fill them with Lancôme eye

trading and affirmed his decision to maintain the allure of the creams, Pola shampoos, Louis Vuitton handbags, and other

house’s luxury and beauty lines by rejecting the daigou sector products that were either much pricier or simply unavailable

which has been responsible for bringing in huge volumes of in China. She would sometimes clear out the store shelves

product (mostly from duty-free) into the China local market. and return home, sending the goods via express delivery to

Arnault has stated: “ We’re refusing and we’re fighting against clients who’d hired her to shop for them. Working as a personal

the so-called parallel exports. A number of our peers need to shopper, or daigou, could earn more than 30,000 yuan ($4,626)

generate revenue and don’t hesitate to shelter resellers who a month for someone willing to cross the border until the

buy products abroad, and then sell them on a discounted price Chinese government closed the border due to COVID, that is.

in China. But we avoid that.… Absolutely ditto for cosmetics, This led Chinese consumers to turn to online marketplaces.

37