Page 65 - EXPORT MAGAZINE

P. 65

REPOR T

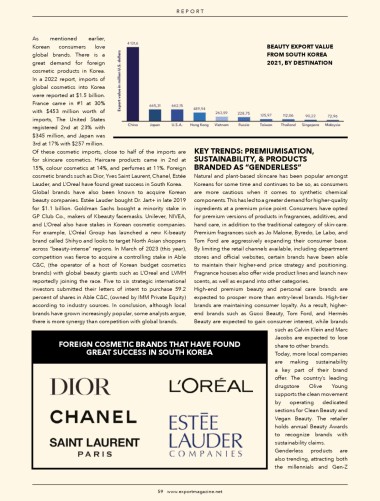

As mentioned earlier,

Korean consumers love BEAuTy EXPoRT VALuE

global brands. There is a fRoM SouTH KoREA

great demand for foreign 2021, By DESTINATIoN

cosmetic products in Korea.

In a 2022 report, imports of

global cosmetics into Korea

were reported at $1.5 billion.

France came in #1 at 30%

with $453 million worth of

imports, The United States

registered 2nd at 23% with

$345 million, and Japan was

3rd at 17% with $257 million.

Of these cosmetic imports, close to half of the imports are KEy TRENDS: PREMIuMISATIoN,

for skincare cosmetics. Haircare products came in 2nd at SuSTAINABILITy, & PRoDuCTS

15%, colour cosmetics at 14%, and perfumes at 11%. Foreign BRANDED AS “gENDERLESS”

cosmetic brands such as Dior, yves Saint Laurent, Chanel, Estée Natural and plant-based skincare has been popular amongst

Lauder, and L’Oreal have found great success in South Korea. Koreans for some time and continues to be so, as consumers

Global brands have also been known to acquire Korean are more cautious when it comes to synthetic chemical

beauty companies. Estée Lauder bought Dr. Jart+ in late 2019 components. This has led to a greater demand for higher-quality

for $1.1 billion. Goldman Sachs bought a minority stake in ingredients at a premium price point. Consumers have opted

GP Club Co., makers of Kbeauty facemasks. Unilever, NIVEA, for premium versions of products in fragrances, additives, and

and L’Oreal also have stakes in Korean cosmetic companies. hand care, in addition to the traditional category of skin-care.

For example, L’Oréal Group has launched a new K-beauty Premium fragrances such as Jo Malone, Byredo, Le Labo, and

brand called Shihyo and looks to target North Asian shoppers Tom Ford are aggressively expanding their consumer base.

across “beauty-intense” regions. In March of 2023 (this year), By limiting the retail channels available, including department

competition was fierce to acquire a controlling stake in Able stores and official websites, certain brands have been able

C&C, (the operator of a host of Korean budget cosmetics to maintain their higher-end price strategy and positioning.

brands) with global beauty giants such as L’Oreal and LVMH Fragrance houses also offer wide product lines and launch new

reportedly joining the race. Five to six strategic international scents, as well as expand into other categories.

investors submitted their letters of intent to purchase 59.2 High-end premium beauty and personal care brands are

percent of shares in Able C&C, (owned by IMM Private Equity) expected to prosper more than entry-level brands. High-tier

according to industry sources. In conclusion, although local brands are maintaining consumer loyalty. As a result, higher-

brands have grown increasingly popular, some analysts argue, end brands such as Gucci Beauty, Tom Ford, and Hermès

there is more synergy than competition with global brands. Beauty are expected to gain consumer interest, while brands

such as Calvin Klein and Marc

Jacobs are expected to lose

foREIgN CoSMETIC BRANDS THAT HAVE fouND share to other brands.

gREAT SuCCESS IN SouTH KoREA Today, more local companies

are making sustainability

a key part of their brand

offer. The country’s leading

drugstore Olive young

supports the clean movement

by operating dedicated

sections for Clean Beauty and

Vegan Beauty. The retailer

holds annual Beauty Awards

to recognize brands with

sustainability claims.

Genderless products are

also trending, attracting both

the millennials and Gen-Z

59 www.exportmagazine.net www.exportmagazine.net

59