Page 68 - EXPORT MAGAZINE

P. 68

REPOR T

Key Lessons Learned from

olive young: Brick-and-

mortar shops in Korea must

do more than offer a physical

space to try and buy.

A diverse product line,

multiple opportunities to

interact (online and offline)

with the retailer, and greater

reasons to come into the

shop in the first place, is a

minimum.

TV SHoPPINg

gIVES uP

SHARES To

LIVE-STREAMINg

Although TV Shopping started in the US, South Korea has In 2022, the National Customer Satisfaction Index (NCSI)

become one of the biggest home shopping markets in indicated, that Hyundai Home Shopping and CJ O Shopping

the world. Since 2009, South Korean Television series and were the home shopping TV channel brands that South Korean

Korean Pop (K-Pop) culture serve as primary beauty trend customers were the most satisfied with, scoring 79 out of 100

drivers. The ‘Korean Wave’ helped drive up demand for points each. GS Home Shopping and Lotte Home Shopping

South Korean cosmetics. followed closely at 78 customer satisfaction points.

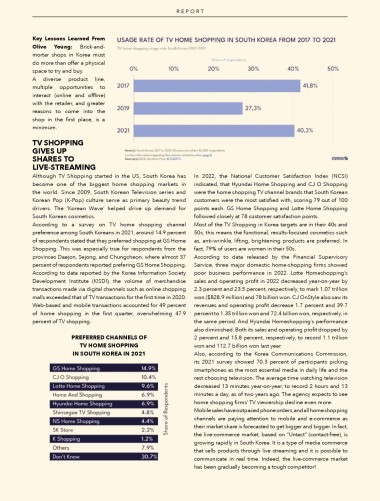

According to a survey on TV home shopping channel Most of the TV Shopping in Korea targets are in their 40s and

preference among South Koreans in 2021, around 14.9 percent 50s, this means the functional, results-focused cosmetics such

of respondents stated that they preferred shopping at GS Home as, anti-wrinkle, lifting, brightening products are preferred. In

Shopping. This was especially true for respondents from the fact, 79% of users are women in their 50s.

provinces Daejon, Sejong, and Chungcheon, where almost 37 According to data released by the Financial Supervisory

percent of respondents reported prefering GS Home Shopping. Service, three major domestic home-shopping firms showed

According to data reported by the Korea Information Society poor business performance in 2022. Lotte Homeshopping’s

Development Institute (KISDI), the volume of merchandise sales and operating profit in 2022 decreased year-on-year by

transactions made via digital channels such as online shopping 2.3 percent and 23.5 percent, respectively, to mark 1.07 trillion

malls exceeded that of TV transactions for the first time in 2020. won ($828.9 million) and 78 billion won. CJ OnStyle also saw its

Web-based and mobile transactions accounted for 49 percent revenues and operating profit decrease 1.7 percent and 39.7

of home shopping in the first quarter, overwhelming 47.9 percent to 1.35 trillion won and 72.4 billion won, respectively, in

percent of TV shopping. the same period. And Hyundai Homeshopping’s performance

also diminished. Both its sales and operating profit dropped by

PREfERRED CHANNELS of 2 percent and 15.8 percent, respectively, to record 1.1 trillion

TV HoME SHoPPINg won and 112.7 billion won last year.

IN SouTH KoREA IN 2021 Also, according to the Korea Communications Commission,

its 2021 survey showed 70.3 percent of participants picking

smartphones as the most essential media in daily life and the

rest choosing television. The average time watching television

decreased 13 minutes year-on-year, to record 2 hours and 13

minutes a day, as of two years ago. The agency expects to see

home shopping firms’ TV viewership decline even more.

Mobile sales have outpaced phone orders, and all home shopping

channels are paying attention to mobile and e-commerce as

their market share is forecasted to get bigger and bigger. In fact,

the live-commerce market, based on “Untact” (contact-free), is

growing rapidly in South Korea. It is a type of media commerce

that sells products through live streaming and it is possible to

communicate in real time. Indeed, the live-commerce market

has been gradually becoming a tough competitor!