Page 165 - EM - Export Magazine Perfumery Edition

P. 165

R R E E P P O O R R T T

With its ageing population and the growing awareness of skin That said, certain areas of personal care products (such as

problems linked to pollution, stress, etc., anti-ageing products bath and shower products and oral care products) have

and/or products for problem skin are also attracting more and resisted the shift to being sold mostly online. Demand for

more consumers, including the youngest. Sun protection is these products is strongly supported by drugstores. These

one of the most buoyant sectors. products are, in fact, slower to shift to e-commerce than

beauty products. There were about 26,500 drugstores &

parapharmacies in Japan as of 2021 (based on Retailing

2022, Japan), across both urban and rural areas, and many

consumers have easy access to physical outlets. Given the

number of drugstores and pharmacies available, purchasing

via e-commerce can be seen as more time-consuming, or

more expensive (than in-store purchases), considering the

time lag and cost of delivery. It is no surprise then, that

value sales through health and beauty specialists in Japan

remained buoyant in 2022, driven in particular by pharmacies

& drugstores.

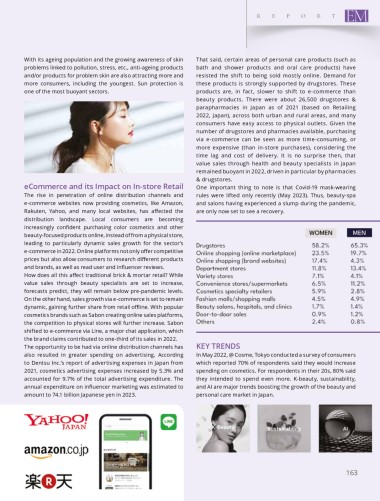

eCommerce and its impact on in-store Retail One important thing to note is that Covid-19 mask-wearing

The rise in penetration of online distribution channels and rules were lifted only recently (May 2023). Thus, beauty-spa

e-commerce websites now providing cosmetics, like Amazon, and salons having experienced a slump during the pandemic,

Rakuten, Yahoo, and many local websites, has affected the are only now set to see a recovery.

distribution landscape. Local consumers are becoming

increasingly confident purchasing color cosmetics and other

beauty-focused products online, instead of from a physical store,

leading to particularly dynamic sales growth for the sector’s

e-commerce in 2022. Online platforms not only offer competitive

prices but also allow consumers to research different products

and brands, as well as read user and influencer reviews.

How does all this affect traditional brick & mortar retail? While

value sales through beauty specialists are set to increase,

forecasts predict, they will remain below pre-pandemic levels.

On the other hand, sales growth via e-commerce is set to remain

dynamic, gaining further share from retail offline. With popular

cosmetics brands such as Sabon creating online sales platforms,

the competition to physical stores will further increase. Sabon

shifted to e-commerce via Line, a major chat application, which

the brand claims contributed to one-third of its sales in 2022.

The opportunity to be had via online distribution channels has KeY TReNDs

also resulted in greater spending on advertising. According In May 2022, @ Cosme, Tokyo conducted a survey of consumers

to Dentsu Inc.’s report of advertising expenses in Japan from which reported 70% of respondents said they would increase

2021, cosmetics advertising expenses increased by 5.3% and spending on cosmetics. For respondents in their 20s, 80% said

accounted for 9.7% of the total advertising expenditure. The they intended to spend even more. K-beauty, sustainability,

annual expenditure on influencer marketing was estimated to and AI are major trends boosting the growth of the beauty and

amount to 74.1 billion Japanese yen in 2023. personal care market in Japan.

163