Page 66 - Export Magazine

P. 66

REPOR T

Skincare still dominates premium international and large FMCG brands

Least affected by the pandemic, the Asia Pacific region dominate omnichannel sales in Indonesia.

is projected to be the primary growth area for the global In Vietnam, there’s a resurgence in premium beauty

beauty and personal care industry, contributing to and personal care products, prompting mass product

73% of global value growth between 2020 and 2025. manufacturers to focus on premiumisation. This may involve

Dominating the beauty sector in Asia Pacific, Skincare is upgrading packaging to emphasise premium features and

expected to surpass overall industry growth in most countries enhancing product quality by adding extra ingredients or

except South Korea and Taiwan. Both mass and premium benefits. Vietnamese consumers are increasingly willing to

skincare categories are set to grow, with premium anti-ageing invest in higher-quality beauty and personal care products,

and basic moisturisers offering the largest opportunities. driving the anticipated premiumisation of the mass segment.

South Korea and Vietnam are leading the projected Let’s take a closer look at a few of the most prominent emerging

growth in the skincare segment after China and Japan, markets in Asia, that all brands should delve into when

signalling a strong and expanding skincare market. considering their brand strategy for growth and expansion.

TRENdS IN SKIN cARE: fAcIAL cARE, Indonesia – The Exotic Splendor

PREMIuM BRANdS, LocAL BRANdS The Indonesian market is rapidly evolving and brimming with

Facial Care potential, thanks to the government’s focus on the industry

The demand for facial care has increased in a number as an economic growth driver. As the world’s fourth most

of countries. An increased interest in purchasing facial populous country with a substantial millennial population,

care products is said to be attributable to the Zoom face Indonesia presents vast opportunities for brands.

phenomenon. The popularity of using Zoom and other In 2023, the Personal

similar technologies for work and personal meetings meant Care segment in

a considerable amount of time was spent in front of the Indonesia stood

camera. The prevalence of making face-to-face calls has out with a market

made consumers want to appear more attractive in front of volume of US$3.41

the camera. When witnessing their “Zoom face”, consumers billion. Skincare,

become aware of various aspects of their facial appearance particularly products

they may not have noticed prior to Covid-19: fine wrinkles on with moisturising and

the forehead, eyes, or even in the lip area when smiling, acne, anti-aging properties,

dull or dry skin. or other skin conditions. To ameliorate one’s dominates with a value

flaws, a greater investment in facial care is made. of US$2.31 billion and

Facial care in China accounted for the bulk of new retail value an expected annual

added in 2016-2021. Facial care was also the best performing growth rate of 13.5%.

category in Indonesia in 2021, with retail value sales rising by Skincare is competitive

13% in current terms to IDR26.0 trillion. Facial care was also and it’s among the

the best performing category in Thailand in 2021, with retail fastest-growing

value sales growing by 8% in current terms to THB75.6 billion. segments, allowing new brands to enter successfully.

Products emphasising natural, halal, organic,

Premium Brands and herbal ingredients, as well as active ingredients

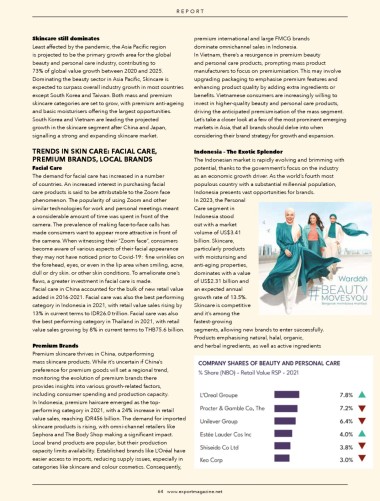

Premium skincare thrives in China, outperforming

mass skincare products. While it’s uncertain if China’s

preference for premium goods will set a regional trend,

monitoring the evolution of premium brands there

provides insights into various growth-related factors,

including consumer spending and production capacity.

In Indonesia, premium haircare emerged as the top-

performing category in 2021, with a 24% increase in retail

value sales, reaching IDR456 billion. The demand for imported

skincare products is rising, with omni-channel retailers like

Sephora and The Body Shop making a significant impact.

Local brand products are popular, but their production

capacity limits availability. Established brands like L’Oréal have

easier access to imports, reducing supply issues, especially in

categories like skincare and colour cosmetics. Consequently,

64

64 www.exportmagazine.net www.exportmagazine.net