Page 68 - Export Magazine

P. 68

REPOR T

Estee Lauder, for example,

has set an example with its modern

flagship store in Mid Valley Megamall

KL, featuring distinctive design

and attracting consumers.

Despite fierce competition in several

areas of the Malaysian Personal Care

and Beauty market, there are many

exciting opportunities for brands

looking to move into this region.

Brands who promote sustainability,

use clean ingredients, and offer a

touch of premium through their

products will do particularly well,

though the shifting of distribution

Other successful brands in the market include Wardah, channels means brands will benefit from partnering with

an Indonesian brand that recently launched its mass someone who is familiar with these matters in order to thrive

colour cosmetics and mass skincare ranges in within this promising market.

mainstream outlets. Safi is also expected to continue

growing its market share with its halal product Taiwan

range designed to appeal to hijab wearers. Taiwan’s Beauty and Personal Care Market is accessible and

Premiumisation is a notable trend here and extends well-regulated, offering strong intellectual property protection

to body care and hair care, with retail sales expected for brands. In 2022, the cosmetics market in Taiwan reached

to grow at a value CAGR of 17%. In the premium sector, approximately €4.67 billion, up 1.5% from the previous year.

fragrances saw significant growth in 2022, with a 24% increase While cosmetics have seen moderate growth, other segments

in retail value sales. Premium skincare has also thrived, like fragrances have eAxperienced higher levels of expansion,

partly due to the entry of international brands like Herborist. making Taiwan a market worth considering for brands.

Local sales of mass beauty and personal care products face Currently, P&G, L’Oréal, and Shiseido collectively hold a 23.7%

tough competition from foreign e-commerce platforms share of the Taiwanese market, which is slightly lower than in

like Beautela, prompting retailers like Watsons to adopt an previous years. Local brand Elca holds a respectable share

omnichannel approach to stay competitive, which of 6.2%. Environmentally-friendly and vegan products have

brands entering the market should also consider. gained popularity, particularly among younger consumers.

The distribution landscape has seen the emergence The demand for male beauty products is also on the rise,

of multi-brand stores offering a wide range of beauty presenting exciting opportunities for brands.

and personal care products. However, standalone stores and Consumers in Taiwan favour products like cushion compacts,

beauty specialists are expected to expand rapidly. face masks, anti-aging solutions, and whitening products.

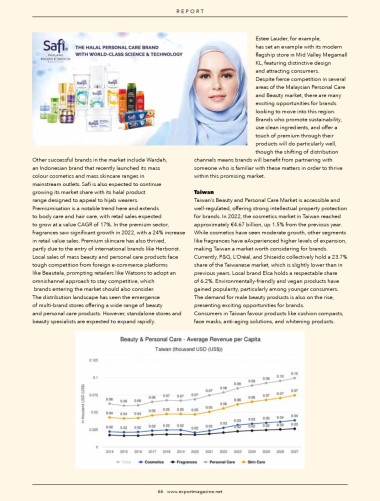

66 www.exportmagazine.net